5 Momentum Stock Screener Strategies That Beat the Market

- Strategy 1: The 52-Week High Breakout

- Strategy 2: The Volatility Contraction Pattern (VCP)

- Strategy 3: Comparative Relative Strength (CRS)

- Strategy 4: The RSI Range Shift (Cardwell Model)

- Strategy 5: Systematic Rotational Momentum (The Index Beater)

- Risk Management Momentum Strategies

- Final Thoughts

- Frequently Asked Questions

The best-performing momentum stock screener over 10 years uses exactly two filters. Six-month lookback. Monthly rebalancing. That's it.

No RSI. No volume. No moving averages.

702% returns versus 250% for the broader market. And almost nobody runs it. Because it feels reckless. Because doing less feels like doing nothing.

This is the trap with stock screening strategies.

You start simple. It works. Then you add RSI to 'confirm.' Volume to 'validate.' 200-DMA to 'stay safe.' Each filter makes the backtest prettier. Each filter makes live performance worse.

The academic term is overfitting. The practical term is overthinking.

Momentum has worked since 1801. The Nifty 200 Momentum 30 compounded at nearly ~20% CAGR over five years. The execution is broken.

This piece breaks down five best stock screening strategies built on momentum - the ones simple enough to survive your own interference.

So without further ado, let's start.

Read more: What is a Stock Screener

Strategy 1: The 52-Week High Breakout

The 52-week high is psychological wall.

Every investor who bought lower is tempted to sell and book profits. Every investor who bought at previous highs is waiting to exit at breakeven. This creates a ceiling of supply. Sellers stacked on top of sellers.

When a stock breaks through anyway?

That supply is gone. No more trapped buyers above. The stock enters what traders call 'blue sky territory' - price discovery with nobody waiting to dump.

Research confirms this works. Stocks near their 52-week highs outperform stocks near their 52-week lows over 6-12 month horizons. The 'buy low, sell high' instinct is precisely wrong here.

The Screener Setup:

The volume filter matters. A breakout without volume is a lie. You want institutional participation confirming the move.

The Numbers:

Backtests on Indian equities from 2010-2024 show 18-22% CAGR. But here's the uncomfortable part: win rate is only 45-50%. Half your trades lose. The strategy works because the winners are massive - a few multibaggers compensate for frequent small losses.

Max drawdown runs -30% to -40% during market corrections. March 2020. The 2018 midcap crash. This isn't a comfortable strategy. It's a profitable one.

1. Case Study: Trent Ltd

Mid-2023. Trent consolidates near Rs 1,500-1,600, bumping against its 52-week high ceiling repeatedly. Not breaking down. Just coiling.

Late 2023. Breakout above Rs 2,000 with volume expansion.

Entry at Rs 2,050. Stop at Rs 1,900.

The stock never looked back. Parabolic move to Rs 4,000+ in 2024. Never breached its 50-DMA once. One trade. 100%+ gains.

2. Case Study: Mazagon Dock

Defense sector re-rating. Atmanirbhar Bharat policy tailwind.

Early 2023. Stock bases near Rs 750-800, forming a launchpad at its 52-week high.

Mid-2023. High-volume breakout above Rs 900.

Entry at Rs 910. The stock barely offered pullbacks. Straight to Rs 2,400+.

190% in under a year. The 'expensive' breakout was the cheapest entry.

3. Case Study: Zomato

The turnaround play. After crashing to Rs 44 post-IPO, Zomato stabilized. Narrative shifted from 'cash burn' to 'profitability' after Q1 FY24.

The 52-week high at Rs 76 had bagholders from the IPO at Rs 169 waiting to sell. When Zomato broke Rs 76, then Rs 100 - that overhead supply got absorbed.

Result: Rs 150+. New 52-week highs in turnaround stocks are potent signals.

Execution Rules:

- Entry: Buy when price crosses 52-week high. Conservative approach: wait until 5-10 minutes before close to confirm it's holding.

- Stop Loss: 7-10% below entry, or below the breakout candle's low.

- Exit: Close below 50-DMA, or if the stock doesn't gain 5% within 10 trading days (cut the squatters).

- Position Size: Risk 1-2% of capital per trade. Rs 10L capital = Rs 10k max risk per trade.

Strategy 2: The Volatility Contraction Pattern (VCP)

A stock rallies 50%. Profit-takers emerge. The stock dips 20%, rallies again, dips 10%, rallies, dips 3%.

Notice the pattern? Each pullback gets shallower. Volatility is contracting.

This is supply absorption in real-time. Weak hands selling to strong hands. When volume dries up during that final 3% dip, the stock is spring-loaded. Sellers are exhausted. Even a small spark of demand triggers an explosive move.

Mark Minervini popularized this. The Indian market rewards it generously.

The Screener Setup:

The magic is in the contraction count. You want 2-4 squeezes before breakout. Each squeeze drains more sellers.

The Numbers:

VCP setups show ~60% success rate - significantly higher than standard breakouts.

Why? You're filtering for supply exhaustion, not just price action.

Risk/reward runs 1:4 or better. Stop loss sits just below the tightest contraction - often 3-5% from entry. Tight stops mean larger position sizes with the same portfolio risk.

1. Case Study: Hindustan Copper

Early 2024. After rallying from Rs 100 to Rs 280, the stock pauses. Forms a cup-and-handle with VCP characteristics in the handle.

Volatility tightens in the Rs 240-280 range. Volume dries up.

Breakout above Rs 280 pivot with massive volume.

Result: Rs 400+. The VCP caught a commodity supercycle entry with minimal risk.

2. Case Study: Tata Motors

July to November 2023. The stock forms a 'High Tight Flag' - a VCP variation.

Price range compresses around Rs 600-650. Sellers exhausted after months of consolidation.

Breakout above Rs 650 in late November.

Result: Rs 1,000+ by 2024. The VCP let traders enter a mature trend at the precise moment risk was lowest.

3. Case Study: Kalyan Jewellers

Strong run, then consolidation in Rs 200-250 range through 2023.

Tight shelf forms. Volatility contracts for weeks while the company digests 30% revenue growth news.

Breakout above Rs 250 pivot.

Result: Rs 400+. The pattern filtered out noise and identified exactly when supply ran dry.

Execution Rules:

- Entry: Buy when price breaks the pivot point (high of the tightest contraction) on expanded volume.

- Stop Loss: Below the low of the last contraction. Usually 3-5% risk.

- Exit (Swing): Sell into strength after 15-20% move.

- Exit (Positional): Hold until price closes below 50-DMA.

- Position Size: Tight stops allow 20-25% portfolio allocation while maintaining same risk.

Strategy 3: Comparative Relative Strength (CRS)

Not RSI. Different concept entirely.

CRS measures how a stock performs versus the Nifty. When the market drops 5% and your stock drops 2% - that's relative strength. When the market drops 5% and your stock goes up - that's a screaming signal.

The behavioral logic: institutions accumulate quietly. They buy when others panic. A stock resisting market weakness means heavy hands are absorbing every dip.

When selling pressure lifts?

These stocks act like beach balls held underwater. They explode upward.

The Screener Setup:

The 'RS new high before price' signal is gold. It's a leading indicator - the stock is winning the relative race before the absolute breakout happens.

The Numbers:

Top decile RS stocks in India have generated 20%+ annual alpha over Nifty historically.

Drawdowns are moderate. High RS stocks buffer mild corrections. In systemic crashes (March 2020), they fall too - but less.

1. Case Study: Apar Industries

Throughout 2023, Nifty Midcap faced volatility. Apar's RS Line kept climbing. Making new highs even while price consolidated.

RS Line breakout preceded price breakout above Rs 2,000.

Result: Rs 6,000+. The RS strategy flagged it as a leader months before the parabolic move.

2. Case Study: REC Ltd

Early 2023. Adani crisis rattled banking/finance sentiment. Nifty Bank fell. Nifty 50 fell.

REC held. Relative strength spiked.

Breakout came with RS Line at all-time highs. Low P/E plus high RS - textbook setup.

Result: Rs 120 to Rs 500+. The RS divergence was the earliest clue.

3. Case Study: HAL

October 2023. Geopolitical tensions trigger sharp market correction. Nifty makes lower lows.

HAL consolidates sideways in a tight range. RS Line shoots up while everything else bleeds.

The moment Nifty stabilized, HAL broke out first.

Result: Doubled in subsequent months. The stock that refused to fall led the recovery.

Execution Rules:

- Entry: Buy when RS Line makes new high, or when stock breaks out while Nifty is still correcting.

- Stop Loss: Below recent swing low, or if RS Line breaks its trend support.

- Exit: RS Line crosses below its 50-day moving average. Leadership lost.

- Position Size: 10-12% per stock. This is a concentrated 'leaders only' strategy.

Strategy 4: The RSI Range Shift (Cardwell Model)

RSI hits 70. 'Overbought.' Sell.

This is how most traders use RSI. It's also why most traders exit winning trades way too early.

Andrew Cardwell flipped the script. In strong bull markets, RSI doesn't oscillate between 30 and 70. The entire range shifts upward.

Bull market range: 40 to 80. Super bullish range: 60 to 80. Bear market range: 20 to 60.

A stock holding RSI above 60 is in a state of high velocity. Relentless buying pressure prevents momentum from cooling. Selling at 70 means exiting trends that still have months to run.

The Screener Setup:

The 40-level is key. In bull trends, 40 is the new 30. Stocks bounce there. If RSI breaks below 40, the trend has shifted back to bearish.

The Numbers:

Win rate exceeds 60% when combined with trend filters. One backtest on optimized RSI settings showed 91% success rate for short-term momentum trades.

The risk: V-tops. When trends reverse abruptly, RSI exits lag. Always pair with a hard price-based stop loss.

1. Case Study: HAL - The Super Bull

Through 2023-2024, HAL's RSI rarely dropped below 50. Sustained in the 60-80 zone for months. Traditional traders sold at RSI 70. Watched the stock rally another 300%.

Cardwell's rules: buy when RSI crosses 60, hold as long as it stays above 40.

Result: Momentum traders rode the entire defense supercycle. One setup. Held for months.

2. Case Study: Tata Motors - The Range Shift

Early 2023. Tata Motors' RSI shifts from bearish 20-60 range to bullish 40-80 range. RSI breakout above 60 in April 2023 coincided with price breakout above Rs 420. During pullbacks, RSI found support near 40. Not panic. Reentry opportunity.

Result: Rs 420 to Rs 1,000. The RSI range shift signaled the regime change early.

3. Case Study: Trent - The 60-Support

Super bullish behavior. In 2024, Trent's RSI found support at 60. Not 40. Not 50. Sixty. Extreme buying pressure. The shallowest dips imaginable. Aggressive traders bought every bounce at RSI 60.

Result: The strategy kept them in one of the year's best performers while others waited for 'better entries' that never came.

Read more: How to Build a Watchlist Like a Research Analyst

Execution Rules:

- Entry (Range Shift): Buy when RSI closes above 60.

- Entry (Dip Buy): Buy when RSI touches 40-50 and turns up.

- Exit: RSI closes below 40. Trend is dead.

- Position Size: Standard 1-2% risk per trade.

Strategy 5: Systematic Rotational Momentum (The Index Beater)

No discretion. No gut feel. Pure algorithm.

This is the exact methodology behind the Nifty 200 Momentum 30 Index. It ranks stocks by momentum score, buys the top 30, rebalances every six months. Eliminates human bias entirely.

The logic: cross-sectional momentum. Compare every stock against every other stock. Find the absolute strongest. Cull losers ruthlessly. Add winners mechanically.

Market leadership rotates - IT to Banks to Pharma to Defense. The algorithm catches each rotation without you needing to predict it.

The Screener Setup:

The volatility adjustment matters. Raw returns favor wild swings. Dividing by volatility favors smooth, consistent gainers. Sharpe-like ranking.

The Numbers:

Nifty 200 Momentum 30 from 2005-2024: ~20.64% CAGR. Nifty 50 same period: ~14-15% CAGR.

That's 5-6% annual alpha. Compounded over 19 years.

Sharpe ratio: 0.89 versus Nifty's 0.57. Better returns, better risk-adjusted returns.

The pain: drawdowns run slightly higher than Nifty.

- 2008: -60% (Nifty -50%)

- 2020: -34% (Nifty -29%)

- 2018: Significant underperformance during midcap crash

But recovery is faster. Post-2020, the Momentum 30 rallied 80% in a year, hitting new highs before value strategies recovered.

How It Played Out:

The algorithm identifies leadership.

In 2023, the system rotated heavily into PSU Defense and Power. BEL. HAL. REC. PFC. These stocks topped the 6-month and 12-month return charts.

It automatically reduced IT and Banks - the laggards.

No human decided 'defense is the next theme.' The algorithm saw the numbers and rotated. Caught the entire defense supercycle mechanically.

- Bajaj Finance? Held for years during its compounder phase - consistent returns, low volatility, high momentum score.

- Tata Motors? Entered the index in 2023-24 after the trend established. Captured the auto cycle upside.

- Trent? High weight in 2023-24 due to linear price rise and low volatility. The algorithm loved it.

Execution Rules (DIY Index):

- Trigger: On rebalance date (June 30, December 31), run the screener.

- Action: Sell stocks dropped out of Top 30. Buy new entrants. Realign weights.

- Discipline: The system forces you to sell falling stars and buy rising stars. No attachment. No hope.

- Position Size: Equal weight or momentum-tilted weight across 30 stocks. Cap at 5% per name.

Risk Management Momentum Strategies

Momentum works. Until it doesn't.

The same force that makes winners keep winning makes them crash harder when trends reverse. This is called momentum crash. It's the price of admission.

- 2008: Momentum strategies fell 60%. Nifty fell 50%.

- 2018-2019: Midcap momentum down 30-40% while Nifty held up, propped by Reliance and HDFC Bank.

- 2020: Momentum dropped 34%. Nifty dropped 29%.

Every single time, momentum fell harder than the market.

But nobody talks about momentum recovering faster. Post-2020, the Nifty 200 Momentum 30 rallied 80% in a single year. Hit new highs while value strategies were still underwater.

The trade-off is real. Sharper pain. Faster recovery. You don't get one without the other.

Survival comes down to three things.

1. Position Sizing (The Equalizer)

Rs 1 lakh in Trent is not the same as Rs 1 lakh in Suzlon.

Trent moves 2% on a normal day. Suzlon moves 8%. Same capital, wildly different risk. Most traders ignore this and blow up when their volatile picks gap down.

The fix: Volatility-based sizing.

Formula: Shares = (Total Capital × 1%) ÷ (Entry Price - Stop Loss Price)

Example:

- Capital: Rs 10 lakhs

- Max risk per trade: 1% = Rs 10,000

- Stock A: Entry Rs 500, Stop Rs 450 (Rs 50 risk per share) → Buy 200 shares (Rs 1L position)

- Stock B: Entry Rs 100, Stop Rs 90 (Rs 10 risk per share) → Buy 1000 shares (Rs 1L position)

Same rupee risk. Different position sizes. You automatically buy fewer shares of wild stocks, more of steady ones.

Risk equalized across the portfolio.

2. Sector Limits (The Concentration Trap)

2023 taught this lesson hard.

Defense was the momentum darling. HAL, BEL, Mazagon Dock - every screener flagged them. Traders loaded up 40-50% in one theme.

The problem: One policy change. One budget disappointment. One geopolitical shift. The entire basket moves as one. Correlation hits 1.

The rule: Never exceed 20-25% in a single sector.

When defense stocks show up in your screener alongside power stocks and auto stocks - that's diversification by accident. Take it. Don't override the signal to concentrate in your 'favorite' theme.

3. Portfolio Heat (The Total Exposure Check)

Individual position sizing means nothing if total exposure is reckless.

Portfolio heat = Sum of all stop loss distances.

If you have 10 positions, each risking 1%, your total heat is 10%. One correlated crash and you're down 10% in a day.

The cap: Total open risk should never exceed 5-10% of equity.

In practice:

- 5 positions at 2% risk each = 10% heat (maximum)

- 10 positions at 1% risk each = 10% heat (maximum)

If the market enters high-volatility regime (VIX spiking, global selloff), cut heat in half. Reduce position sizes or close marginal positions.

The Drawdown Contract

Before you run any momentum screener, sign this contract with yourself:

- I will see -30% drawdowns at some point. I will not abandon the strategy.

- I will underperform Nifty during certain years. I will not chase what's working.

- I will hold winners that look 'overextended' because that's how momentum works.

- I will cut losers fast even when 'the fundamentals are intact.'

Momentum strategies that backtested at 20% CAGR included all the crashes. The returns are real. But only for those who stayed.

Final Thoughts

Five strategies. One common thread.

The best stock screening strategies in each category used the fewest filters. 52-week high breakouts. RSI above 60. Top 30 by momentum score. No secret indicators. No proprietary algorithms. Just price, volume, and time.

The Indian market rewards momentum. Nifty 200 Momentum 30 has compounded at 20.64% since 2005 versus Nifty's 14-15%. MSCI India Momentum delivered 22% versus 17% for standard MSCI India. The data is overwhelming.

The returns go to people who run a simple screener and don't abandon it during the inevitable 30% drawdown.

Pick Your Lane:

There's no 'best' strategy. There's only the one you'll actually follow when it's down 25% and Twitter is calling momentum dead.

Frequently Asked Questions

1. What is the best momentum strategy screener?

Depends on your style. For breakout traders, a 52-week high screener with volume confirmation (1.5x average) and price above 200 DMA - backtests show 18-22% CAGR. For passive investors, replicating the Nifty 200 Momentum 30 methodology (top 30 stocks by risk-adjusted returns, rebalanced semi-annually) has delivered 20.64% CAGR since 2005. Simpler screeners consistently beat complex ones.

2. What are the best screening criteria for stocks?

Five criteria matter most: price above 200 DMA and 50 DMA (confirms uptrend), within 25% of 52-week high, volume above 20-day average on breakouts, RS Rating above 80 (outperforming market), and RSI between 60-80. Adding more filters typically hurts live performance even if backtests look better.

3. What is the 7% rule in stock trading?

Sell any stock that falls 7-10% below entry price, no exceptions. A 7% loss requires 8% to recover. A 50% loss requires 100%. Most momentum strategies use 7-10% hard stops, with tighter 3-5% stops for VCP setups where entries are at low-volatility pivots.

4. What is the most successful stock screener?

In India, the Nifty 200 Momentum 30 methodology has the strongest track record - 20.64% CAGR versus 14-15% for Nifty 50 over 19 years. Sharpe ratio of 0.89 versus 0.57. No discretionary screener has publicly matched this over a comparable period.

5. Which is the best stock screener for long term investing in India?

Comparative Relative Strength (CRS) screeners. Filter for stocks where RS Line (stock price ÷ Nifty) is above its 50 DMA and hitting new highs. Top-decile RS stocks have generated 20%+ annual alpha over Nifty historically. Trendlyne and Screener.in allow custom RS screening for NSE stocks.

6. Why is momentum strategy underperforming in 2025?

Momentum crashes happen when market trends reverse sharply. In 2025, sector rotation accelerated - yesterday's winners (defense, PSUs) gave way to new leadership. This is normal. Momentum underperformed in 2018 too, then rallied 80% in 2020-21. The strategy works over cycles.

7. Should I invest in momentum index funds like UTI or Motilal Oswal Nifty 200 Momentum 30?

If you want momentum exposure without active management, yes. Both funds track the same index (20.64% CAGR since 2005). UTI has lower expense ratio. Motilal Oswal has longer track record. Either beats running your own screener inconsistently. The edge is in not abandoning the strategy during drawdowns.

- Strategy 1: The 52-Week High Breakout

- Strategy 2: The Volatility Contraction Pattern (VCP)

- Strategy 3: Comparative Relative Strength (CRS)

- Strategy 4: The RSI Range Shift (Cardwell Model)

- Strategy 5: Systematic Rotational Momentum (The Index Beater)

- Risk Management Momentum Strategies

- Final Thoughts

- Frequently Asked Questions

Related Blogs

View more-

Quarterly Results Explained: 8 Ratios That Reveal the Real Story

DIY Research

20 Dec, 2025

-

How to Build a Watchlist Like a Research Analyst

DIY Research

20 Nov, 2025

-

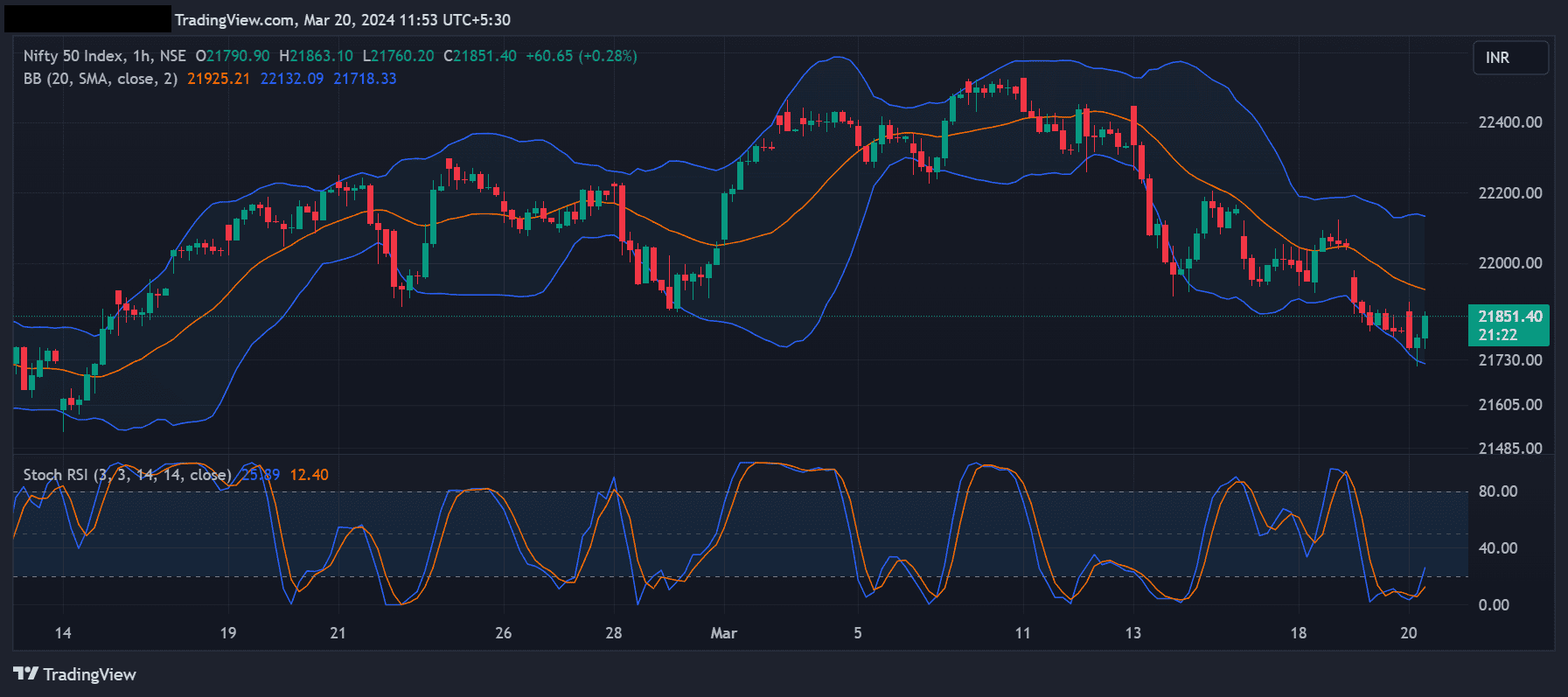

Unlocking Trading Potential: Exploring the Dynamic Features of TradingView's Research 360 Charts

DIY Research

30 Nov, 2023

-

How Research 360 Can Enhance Your Stock Analysis

DIY Research

18 Sep, 2023