How to Build a Watchlist Like a Research Analyst

If you have spent some time in the stock market, you have likely heard the term ‘watchlist’. For most retail investors, it often ends up being a random collection of stocks they came across on social media or through television discussions. That, however, is not a watchlist, it’s a list built on impulse and driven by FOMO (Fear of Missing Out).

A professional watchlist is entirely different. It’s not a list of stocks to buy immediately but a set of companies studied in depth. When markets panic, and they always do, professionals don’t react emotionally. They refer to their watchlist, check their pre-determined buy prices, and act with conviction while others sell in fear.

Building a research-backed watchlist is not about chasing stock tips; it’s about following a structured process. It requires effort and patience, but it’s what separates disciplined investors from speculators.

What Kind of Watchlist?

There are various types of watchlists, a ‘trading watchlist’ for short-term price movements, a ‘sector watchlist’ to track companies within an industry, and a ‘core watchlist’ meant for long-term investments.

This article focuses on building a core watchlist, a list of quality companies one would be comfortable owning for the next 3, 5, or even 10 years, provided they are available at the right price.

A professional’s core watchlist serves three primary purposes:

To Define the ‘Circle of Competence’: Coined by Warren Buffett, this concept emphasises focusing on businesses that are well understood. For instance, an investor may be familiar with banking and IT but not with pharmaceutical research. Much like institutional analysts who specialise in one sector, a well-curated watchlist reflects an individual’s own circle of competence.

To Wait Patiently for ‘Mr. Market’: Benjamin Graham, the father of value investing, introduced the idea of Mr. Market, a metaphor for market volatility and investor emotions. On some days, he offers shares at inflated prices; on others, at deep discounts. Smart investors wait for those low points. A strong watchlist helps identify quality companies worth buying when Mr. Market turns pessimistic.

To Act with Speed and Conviction: The best opportunities often appear during extreme pessimism, as seen during March 2020, when markets crashed. That is not the time to begin researching companies like Bajaj Finance or Asian Paints. Research must be completed during calmer times. Professionals keep their analysis, fair value estimates, and conviction ready in advance so they can act decisively when opportunities arise.

Step 1: Building the Funnel

A research analyst doesn’t rely on a single source to create a watchlist. They build a wide funnel of ideas and then filter them systematically.

Here are some effective ways to find investment ideas:

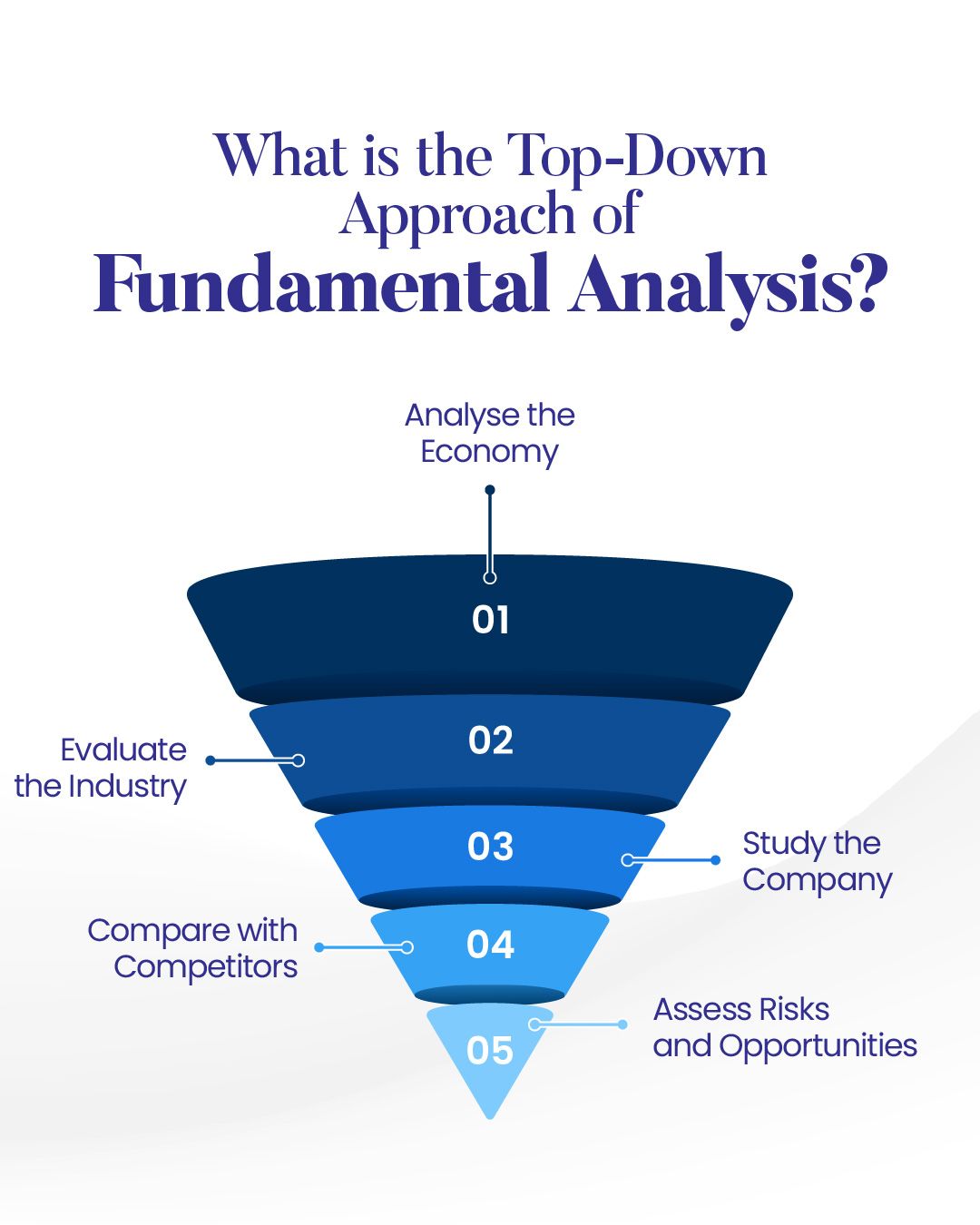

A) The Top-Down Approach (Finding Themes)

This method begins with the broader picture, macroeconomic trends or government policies, and narrows down to companies that stand to benefit.

Follow Government Policy: Identify where policy support or spending is directed.

Example: The Production-Linked Incentive (PLI) scheme for manufacturing points towards opportunities in electronics companies such as Dixon Technologies.

Identify Megatrends: Look for structural shifts in the economy.

Example: The move from unorganised to organised retail benefits companies like Titan (Tanishq), Trent, and Avenue Supermarts (DMart).

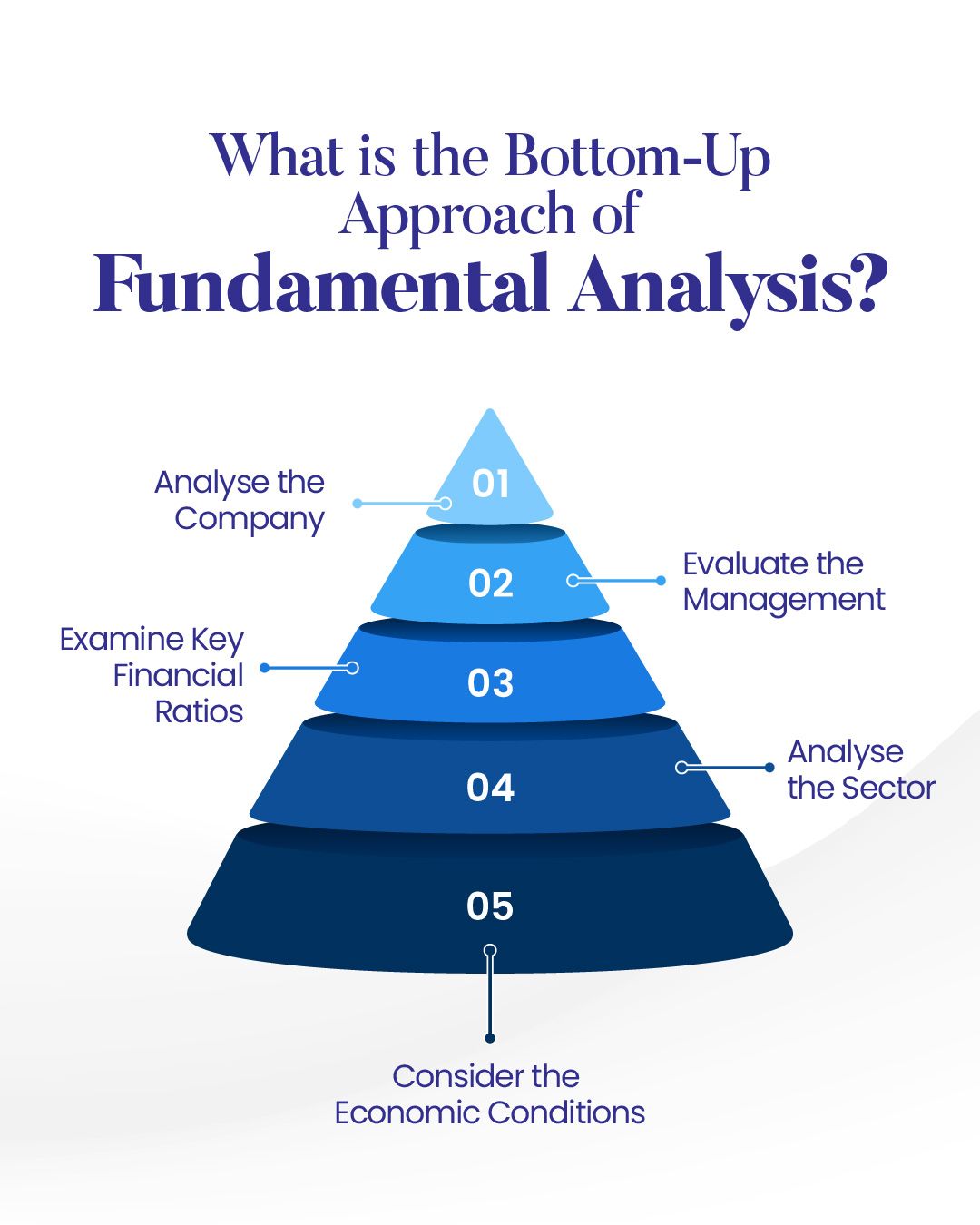

B) The Bottom-Up Approach (Finding Businesses)

This approach starts with companies rather than macro trends. It focuses on identifying strong businesses regardless of sector momentum.

Be an Observant Consumer: Pay attention to products and services that consistently earn customer loyalty.

• Are certain paint brands such as Asian Paints or adhesives like Pidilite (Fevicol) always preferred?

• Are queues at banks such as HDFC Bank or ICICI Bank always long?

• Is one particular digital payments app dominating usage among peers?

C) Use Stock Screeners (Intelligently)

A stock screener is a useful tool but must be applied wisely. Screening for low P/E or high growth alone can mislead. Analysts use screeners to identify quality companies, not just cheap ones.

A professional filter may include:

Market Cap > Rs 10,000 crore (established players)

ROE > 20% (for the last five years)

Sales CAGR > 20% (for the last five years)

Debt-to-Equity < 0.5 (low leverage)

This produces a refined list of 50–100 high-performing businesses worth deeper analysis.

D) Be a News-Hound (the Right Way)

Being informed is important, but not through daily TV tips. Reading credible financial publications such as The Economic Times or Business Standard helps identify sectoral trends, policy changes, or disruptions that can create long-term opportunities.

At this stage, the list should ideally contain 30–50 potential companies. The next step is refinement.

Step 2: The First Filter

Tracking 50 companies is impractical. The next task is to narrow the list to 15–20 names using qualitative parameters.

For each company, four fundamental questions should be asked. If the answer to any is ‘No’ or ‘Unclear’, the stock should be dropped.

A) Understanding the Business Model

Can the company’s business model be explained in one line? If not, it’s outside the circle of competence.

Example (Simple): Asian Paints makes money by selling branded paints to homeowners and contractors.

Example (Complex): A company engaged in credit derivatives or structured products may be better avoided.

B) Assessing Management and Promoter Quality

Management quality is critical, particularly in India.

• Track Record: Has the promoter created long-term shareholder value or been linked to controversies?

• Capital Allocation: Are profits reinvested wisely or diverted into unrelated ventures?

• Communication: Do annual letters discuss both achievements and challenges transparently?

C) Evaluating the Economic Moat

A moat is a lasting competitive edge that protects profitability. Types of moats:

• Brand: Nestlé (Maggi), Pidilite (Fevicol)

• Switching Costs: TCS / Infosys, clients find it difficult to switch vendors

• Network Effect: Info Edge (Naukri.com), both job seekers and recruiters rely on the same platform

• Cost Advantage: DMart, unmatched efficiency enabling consistently lower prices

D) Checking Financial Health

A quick financial scan helps eliminate weak candidates.

• Debt: Is the Debt-to-Equity ratio comfortably below 1? (Banks and NBFCs are exceptions.)

• Cash Flow: Is operating cash flow positive? Paper profits without cash are warning signs.

Companies passing all four checks form the shortlist, ideally 15–20 names.

Step 3: The Deep Dive

This stage distinguishes professionals from casual investors. For each shortlisted company, a concise one-page document should be prepared, an investment thesis updated every quarter.

Each thesis should cover:

A) Investment Rationale

• Summarise the core reason for interest.

• Example: Titan’s Tanishq brand enjoys strong consumer trust (moat) and benefits from the shift towards organised jewellery retail (megatrend). Its expansion in tier-2 and tier-3 cities supports sustainable earnings growth of 15–20% over the next few years.

B) Key Metrics to Track

• Monitor business performance rather than share price.

• Banks (e.g., HDFC Bank): Net Interest Margin (NIM) and Non-Performing Assets (NPAs)

• Retailers (e.g., DMart): Same-Store Sales Growth (SSSG) and Sales per Square Foot

• Manufacturers (e.g., Asian Paints): Sales Volume Growth and EBITDA Margins

C) Key Risks (Bear Case)

Documenting potential risks maintains objectivity.

For instance,

• Asian Paints: A sustained rise in crude oil prices could erode margins.

• HDFC Bank: Intense price competition from a new entrant like Jio Financial could compress margins.

D) Valuation and Action Triggers

Define when to act, by price or by event.

• Price Trigger: If TCS historically trades at 25× P/E and currently stands at 30×, it may become attractive at 22× or lower.

• News Trigger: Consider Asian Paints if crude falls below $70 per barrel, or reassess banks after the RBI’s policy update.

Step 4: Maintenance and Action

Building a watchlist is only the beginning. Maintaining it requires discipline and periodic review.

A watchlist is like a garden, it needs regular pruning.

A) Quarterly Review

Every quarter, review company results, presentations, and concall transcripts.

Ask:

• Did the company deliver on its stated goals?

• What did management communicate about growth and challenges?

• Have any of the key risks materialised?

B) When to Buy

Buy when a fundamentally strong company faces a temporary issue, such as weak results from a short-term disruption, or when markets fall sharply. Preparation enables confident decision-making.

C) When to Remove a Stock

A stock should be removed or sold not when the price dips, but when the investment thesis breaks.

• Promoter integrity issues (breach of management quality)

• Permanent moat disruption due to new technology

• Poor capital allocation or reckless acquisitions

D) A Note on Diversification

A watchlist may focus on sectors within one’s circle of competence, that’s acceptable. However, the final portfolio must remain diversified. The watchlist is the menu; the portfolio is the balanced plate.

Wrapping Up

The process of Funnel, Filter, Deep Dive, Organise, and Maintain forms the foundation of professional investing. It may not be glamorous or quick, but it ensures preparedness, discipline, and focus within one’s circle of competence.

The right watchlist helps investors move away from speculation towards informed, long-term investing, built on research, patience, and conviction.

*The companies mentioned in the article are for information purposes only. This is not investment advice.

Related Blogs

View more-

Quarterly Results Explained: 8 Ratios That Reveal the Real Story

DIY Research

20 Dec, 2025

-

5 Momentum Stock Screener Strategies That Beat the Market

DIY Research

16 Dec, 2025

-

Unlocking Trading Potential: Exploring the Dynamic Features of TradingView's Research 360 Charts

DIY Research

30 Nov, 2023

-

How Research 360 Can Enhance Your Stock Analysis

DIY Research

18 Sep, 2023